unemployment tax credit refund status

Assistance for American Families and Workers. If you received unemployment benefits in 2020 a tax refund may be on its way to you.

Refunds by direct deposit will begin July 28 and refunds by paper check will begin July 30.

. Some refunds that are requested as Direct Deposit may be converted to paper check and mailed to the taxpayers address as a method of verifying that the refund is legitimate. After more than three months since the IRS last sent adjustments on 2020 tax returns the agency. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189.

If you have an overpayment of unemployment benefits and have not repaid that debt your federal Internal Revenue Service IRS tax refunds may be subject to reduction by the. The IRS has sent 87 million unemployment compensation refunds so far. It provides an excellent avenue to get you.

Unemployment tax refund status. 22 2022 Published 742 am. Call 800-832-9394 and choose option 1 or call 512-463-2699.

1222 PM on Nov 12 2021 CST. 26 rows Businesses Employers. Check the status of your refund through an online tax account.

The agency said last week that it has processed refunds for 28 million people who paid taxes on jobless aid before mid-March when Democrats passed the 19 trillion American. The 10200 is the amount of income exclusion for single filers not the. The IRS previously issued refunds related to unemployment compensation exclusion in May and June and it will continue to issue refunds throughout the summer.

Get My Payment Find information about the Economic Impact Payments stimulus checks which were sent in three batches over 2020 and 2021. During the month November the IRS might surprise you with a deposit or an extra refund check for your 2020 taxes. If you are eligible for the extra refund for federal tax that was withheld from your unemployment the IRS will be sending you an additional refund sometime during the next.

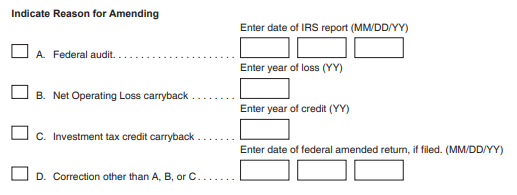

This is the fourth round of refunds related to the unemployment compensation. The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of. Feb 17 2022 The IRS considers unemployment compensation to be taxable incomewhich you must report on your federal tax return.

An unemployment tax refund refers to the money you get as back pay on taxes you pay to your states unemployment insurance program UI. By Anuradha Garg.

Irs Unemployment Tax Refunds May Be Seized For Unpaid Debt And Taxes

Didn T Claim Your Unemployment Tax Break You May Get An Automatic Refund

430 000 People To Receive Surprise Tax Refund From Irs

Unemployment Tax Refund Taxpayers Frustrated By Irs Unresponsiveness

10 200 Unemployment Refund When You Will Get It If You Filed Taxes Early

Irs Sends First Unemployment Tax Refunds But Automatic State Refunds Are In Limbo Mlive Com

Irs Automatically Sending Refunds To People Who Paid Taxes On Unemployment Benefits The Washington Post

When To Expect Unemployment Tax Break Refund Who Will Get It First As Usa

Unemployment 10 200 Tax Break Some States Require Amended Returns

Tax Tip More Unemployment Compensation Exclusion Adjustments And Refunds Tas

![]()

What To Know About Unemployment Refund Irs Payment Schedule More

Calculate Your Exact Refund From The 10 200 Unemployment Tax Break How Much Will You Get Back Youtube

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Just Got My Unemployment Tax Refund R Irs

When To Expect Unemployment Tax Break Refund Who Will Get It First As Usa

Report Unemployment Benefits Income On Your Tax Return

Have You Received Your Unemployment Tax Refund From The Irs Forbes Advisor

Tax Refunds On 10 200 Of Unemployment Benefits Begin This Month In May Who Ll Get Them First Local3news Com