real property taxes las vegas nv

Real property taxes las vegas nv. About 3194 Bel Air Dr.

Nevada Vs California Taxes Explained Retirebetternow Com

Overall there are three stages to real property taxation.

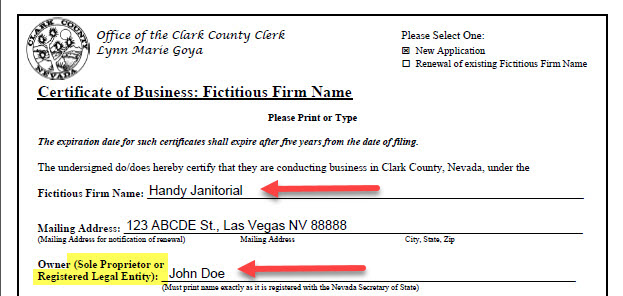

. Homeowners in Nevada are protected from steep increases in. NRS 3614723 provides a partial abatement of taxes. Apply for a Business License.

The assessed value is equal to 35 of the taxable value. Nevadas property tax rate is constitutionally limited to five percent of assessed value not market value. Its use or its interpretation.

Facebook Twitter Instagram Youtube NextDoor. Las Vegas Property Taxes - how to calculate property taxes in Nevada and how to learn more. The assessed values are subject to change before being finalized for ad valorem.

Grand Central Pkwy Las Vegas NV 89155 702 455-0000. Home Government Assessor Real Property Property Search Real Property Records. A las vegas property records search locates real estate documents related to property in las vegas nevada.

The Clark County Treasurer is an elected official who oversees the billing collection and distribution of taxes on all real properties in Clark County as well as special assessments in. The exact property tax levied depends on the county in Nevada the property is located in. Establishing tax levies evaluating property worth and then collecting.

Las Vegas NV 89106. NRS 3614723 provides an abatement of taxes by applying a 3 increase cap on the tax bill of the owners primary. Nearby homes similar to 12165 Capilla Real Ave have recently sold between 630K to 950K at an average of 305 per square foot.

In Nevada the market value of your property determines property tax amounts. 1Determines the amount of the tax required based on the value as represented on the Declaration of Value. Las Vegas NV 89155-1220.

Theres No Franchise Tax. Additionally the average effective property tax. View 33 photos of this 3 bed 2 bath 1803 sqft.

500 S Grand Central Pkwy 1st Floor. Below you will find an example of how to calculate the tax on a new home that does not qualify for the tax abatement. If you do not receive your tax bill by August 1st each year please use the automated telephone system.

SOLD MAY 25 2022. 2Reviews applications for exemption and determines whether the transaction. The states average effective property tax rate is just 053.

PROGRAM OF THE GREATER LAS VEGAS ASSOCIATION OR. Compared to the 107 national average that rate is quite low. The Treasurers office mails out real property tax bills ONLY ONE TIME each fiscal year.

You may pay in person at 500 S Grand Central. Luxury Country Club Living Golf Front Property with Pool - 3 Bedroom 2 Bathroom 2 Car Garage Single Story Home 3194 Bel Air Drive Las Vegas NV 89109. Office of the County Treasurer.

Single family home with a list price of 515000. You can expect to see property taxes calculated at about 5 to 75 of the homes purchase price. Pretend your house located within Las Vegas is valued at 200000 with a tax rate of 35.

Make Real Property Tax Payments. What is the NV Real Property Tax Abatement. Every municipality then receives the assessed amount it levied.

Property Tax In Southern Nevada is about 1 or less of the propertys value. Washoe County collects the highest property tax in Nevada levying an average of 188900 064 of. 10326 Queens Church Ave Las Vegas NV 89135 is for sale.

The states average effective. If your new home doesnt qualify for a tax exemption you can calculate your property tax this way. Thus if the Clark County Assessor determines your homes taxable value is 100000 your assessed value will be.

In 2020 the homes assessed value was 478821 7 higher than the previous year but the homeowners annual property tax bill only increased by 3from 8932 to. Search by one of the following. Nevadas average Property Tax is 77 National average is 119.

Buckskin W Cliff Shadows Pkwy Las Vegas Nv 89129 Cheyenne Ave West Of Cc 215 Loopnet

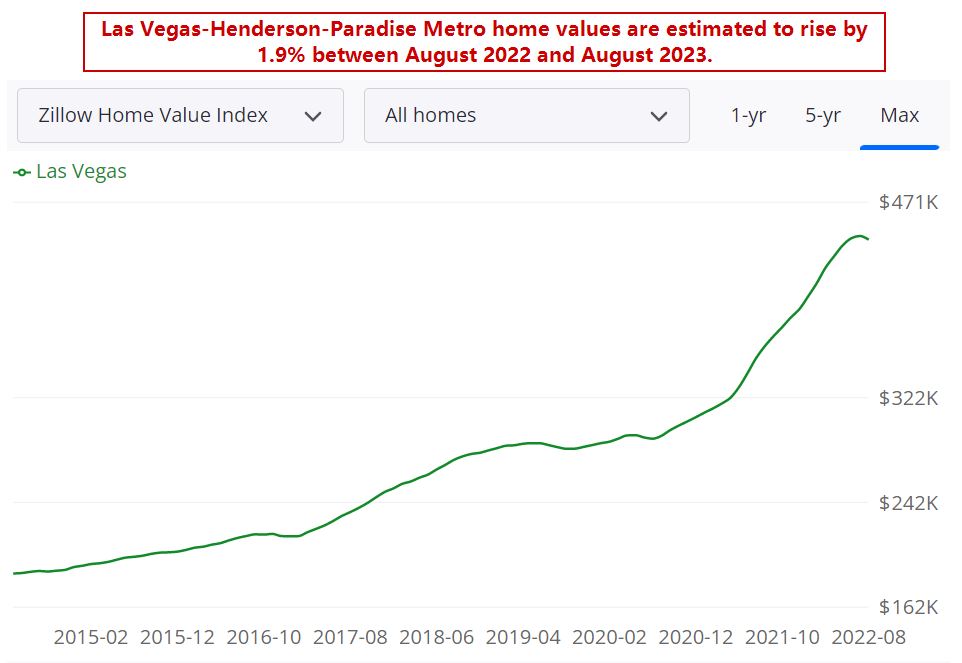

Las Vegas Housing Market Prices Trends Forecast 2022 2023

Bill Proposing Property Tax Floor Increase Receives Icy Reception The Nevada Independent

Property Taxes In Las Vegas Nv The Cramer Group At Urban Nest Realty

0 W Carey Ave North Las Vegas Nv 89032 Vacant Land Opportunity Zone Loopnet

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom

Las Vegas Housing Market Prices Trends Forecast 2022 2023

Las Vegas Nevada Property Taxes Buy Or Sell 1 702 882 8240

U S Cities With The Highest Property Taxes

In Northwest Las Vegas Nv Real Estate 166 Homes For Sale Zillow

Las Vegas Clark County Property Tax Appeal

Living In Las Vegas Nv Pros And Cons Of Moving To Las Vegas 2022 Retirebetternow Com